Does Financial Inclusion Reduce Gender Bias?

Behavioral and Attitudinal Shifts among IVDP members.

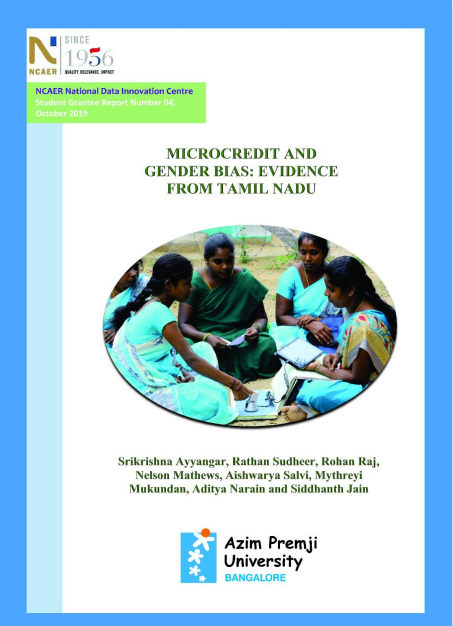

A study by students from Azim Premji University funded by the National Council of Applied Economic Research.

Does Financial Empowerment reduce gender bias? Research has highlighted what is common in many households in the world – that (mothers and daughters bear a ‘double burden’ which is to keep the house running and also go to work. Is it the case that microfinance programmes have been able to bring about an attitudinal shift such that the double burden that women face is reduced? In other words, has the attitude of women who have been microcredit members for many years, changed such that they look at boys and girls as equal children?

These were some of the questions that students from Azim Premji University sought to answer as part of their research project with IVDP members. The project proposal won a national level award from the National Council of Applied Economic Research (NCAER), to undertake a statistical study using a survey and a recent psychological test called the Implicit Association Test (IAT).

The IAT test, developed by some researchers at Harvard University in the US has been used to understand several kinds of bias associated with gender, race, nationalism and other similar attitudes. This study is perhaps the first study of gender bias amongst microfinance members. The study sought to understand whether membership of a SHG belonging to IVDP in fact helps in the reduction of gender bias.

To undertake such a study, the research was designed to compare exactly the same kinds of women with the only difference being that one group of women had been in IVDP for a considerable period of time and another group of women had been in IVDP for a year or less. For example, the research sought to compare, say, two 35 years old women having the same level of education, access to economic and infrastructure – the only difference being years of membership in IVDP, which would help in isolating that it was only IVDP membership and no other factor which causes the change in explicit and implicit gender biases.

The group of researchers were able to isolate a little more than 550 such members amongst the overall members in IVDP, and were able to split them into two groups (one group from these women having more than 13 years membership experience, and another with less than 1 year of membership experience). Both groups of women were asked to respond to survey questions and to undertake the IAT test.

The statistically rigorous findings were interesting. First results showed that there was a big difference between explicit and implicit biases. Women are able to change themselves but changing internal psychological prejudices that are beyond their control requires more than financial inclusion.

For example, results showed that membership in IVDP has helped women understand that they are equally if not more capable in handling household related financial responsibilities compared to their spouses. Clearly, financial inclusion by IVDP has empowered women to handle finances and this is a fundamentally huge shift towards greater gender equality. Second,however, the IAT results showed that attitudinal biases towards the girl child amongst senior SHG members remains almost the same as junior SHG members (of similar background characteristics). Third result was that senior SHG members belonging to the Scheduled Caste community showed a significant reduction in bias compared to similar members of other communities. This interesting outcome has to be understood better through future research.

Clearly, IVDP has had a substantive impact in bringing about a behavioral change amongst IVDP members though attitudinal change remains a challenge. However, this challenge is not unique perhaps to IVDP alone, but to all microfinance organizations and programmes. Policy makers may have to take cognizance of the fact that additional interventions may be required over and above financial inclusion to have any influence upon attitudinal biases that we unconsciously carry in us over several generations.

Researchers:

Rathan Sudheer, Rohan Raj, Nelson Matheran, Aishwarya Salvi,

Aditya Narayan Rai, Mythreyi Mukundan, and Siddhanth Jain

Mentor:

Srikrishna A., Assistant Professor, Azim Premji University, Bangalore.

His development program empowers women through financial savings.

His development program empowers women through financial savings.

Dorcas Cheng-Tozun/ June 23,2016

Tamil Nadu, India | IVDPKrishnagiri

A third-generation Christian in a predominantly Hindu country, Kulandai Francis has dedicated his life to serving the mos underprivileged populations in southern India.

Through the Integrated Village Development Project (IVDP), an NGO headquartered in the Tamil Nadu state, Francis’ community development efforts resist and reverse the ethnic, religious, and socio-economic divisions that persist in his country.

He joined the Father of the Holy Cross as a young man with the intention of becoming a priest. As part of his coursework, he become involved in relief work during the Bangladeshi War and severe drought in Pune. Afterwards, he shifted toward community development, ranging from watershed projects and scholarships for children to supplying clean toilets and sanitary pads.

Additionally, his organization launched a collective of rural women who create savings accounts and secure loans to fund energy, education, healthcare, and other necessities for their families. Through more than 10,000 saving home groups, comprising 184,000 women, the women have been able to access more than 45 billion rupees in capital.

“Jesus didn’t choose the qualified as his disciples; likewise, all the members of IVDP are poor and uneducated women in the society,” Francis says.

In 2012, Francis received the Roman Magsaysay Award, a prestigious honour nicknamed Asia’s Nobel Prize, for “his visionary zeal, his profound faith in community energies, and sustained programme in pursuing the holistic economic empowerment of thousands of women and their families in rural India.”